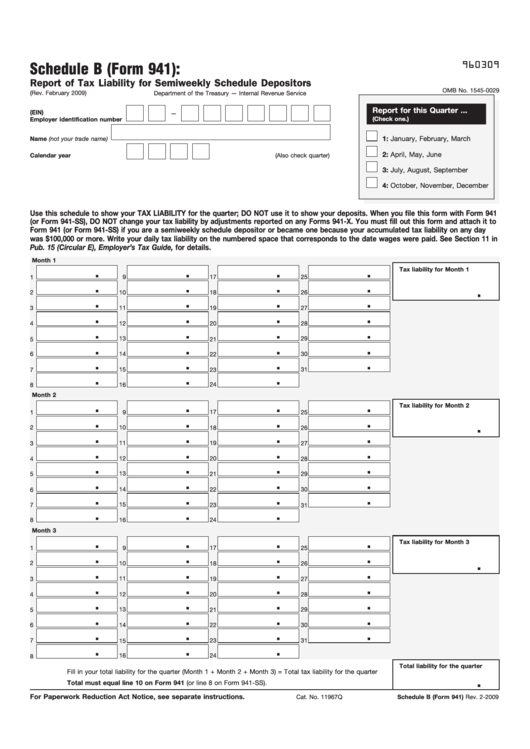

Printable Form 941 Schedule B – The form 941 schedule b pdf features one page and is not impossible to sort out under your own steam. Draft instructions for schedule b, report of tax liability for semiweekly schedule depositors, were updated with guidance about the end of the cobra. Go digital and save time with signnow, the. We last updated the report of tax liability for semiweekly schedule depositors in january 2023, so this is the latest version of 941 (schedule b), fully updated for tax year 2022.

File 941 Online Efile 941 For 4.95 Irs Form 941 For 2022

Printable Form 941 Schedule B

File schedule b (form 941) if you are a semiweekly schedule depositor. Complete instructions for schedule b (form 941) (rev. January 2017) department of the treasury — internal revenue service 960311 omb.

How To Fill Out The Schedule B Of Form 941?

The filing of schedule b depends on your deposit frequency. Report of tax liability for semiweekly schedule depositors (rev. October, november, december go to www.irs.gov/form941 for instructions and the latest.

Instructions For Schedule B (Form 941) Online With Us Legal Forms.

Instruction 941 schedule b (pr) (rev. Qualified small business payroll tax credit for increasing research activities. Instructions for schedule b (form 941 (pr)), report of tax liability for semiweekly schedule depositors (puerto rico).

15 Or Section 8 Of Pub.

Learn how to file the tax form properly without making any mistakes on it from our instructions. 3 by the internal revenue service. Schedule b with form 941, the irs may propose an “averaged” ftd penalty.

Printing And Scanning Is No Longer The Best Way To Manage Documents.

You are a semiweekly depositor if you: Explore instructions, filing requirements, and tips. Schedule b must be filed along with form 941.

Handy Tips For Filling Out 2021 Form 941 Schedule B Online.

Draft instructions for schedule b of the 2022 form 941, employer’s quarterly federal tax return, were released feb. Here’s a simple tax guide to help you understand form 941 schedule b. Form 941 is used for employer’s quarterly federal tax return.

If You Deposit Monthy Or.

I'll provide information on how it will be included when filing your 941 forms. Reported more than $50,000 of employment taxes in the. The irs form 941 schedule b for 2023 is used by semiweekly schedule depositors that report more than $50,000 in employment taxes.

Employer S Quarterly Federal Tax Return Created Date:

See deposit penalties in section 11 of pub. The irs form 941 schedule b is a tax form for reporting employer’s tax liabilities for semiweekly pay schedules. Easily fill out pdf blank, edit, and.

Form 941 Schedule B Edit, Fill, Sign Online Handypdf

File 941 Online Efile 941 for 4.95 IRS Form 941 for 2022

Schedule B (Form 941) Report Of Tax Liability For Semiweekly Schedule

941 form 2020 schedule b Fill Online, Printable, Fillable Blank

Fillable Worksheet 1 Form 941 Printable Forms Free Online

IRS Instructions 941 Schedule B 20212022 Fill and Sign Printable

2014 Form IRS 941 Schedule BFill Online, Printable, Fillable, Blank

Printable 941 Tax Form Printable Form 2021

File 941 Online How to File 2023 Form 941 electronically

941 Form 2023 schedule b Fill online, Printable, Fillable Blank

Form 941 (Schedule R) Allocation Schedule for Aggregate Form 941

Instructions For Schedule B (Form 941) Report Of Tax Liability For

Fillable Form 941 Schedule B 2020 Download Printable 941 for Free

Form 941 (Schedule B) Report of Tax Liability for Semiweekly Schedul…

Form 941 3Q 2020